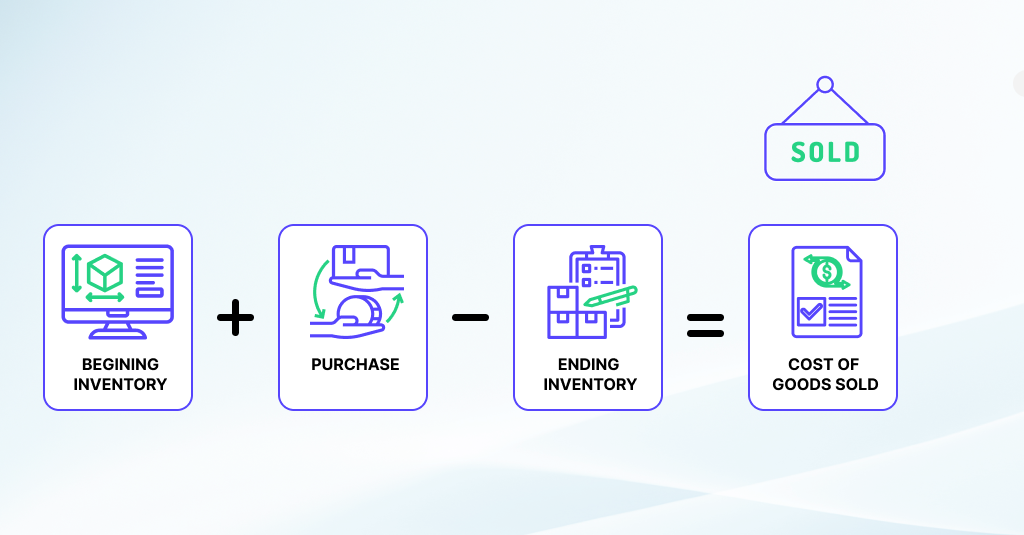

What is Cost of Goods Sold (COGS)?

Cost of Goods Sold, commonly abbreviated as COGS, refers to the direct costs involved in booking accommodations for clients. This includes the expenses directly tied to the acquisition of services such as room rates paid to hotels. COGS is a critical metric for travel agencies and booking platforms as it directly impacts the gross profit.

COGS for Travel Companies

In the context of a travel agency or booking platform, Cost of Goods Sold (COGS) typically accounts for 70-80% of the total sales volume, also known as revenue or gross booking volume. This percentage can vary based on factors like the type of accommodations, location, and seasonal demand. It’s important to note that COGS includes only the direct costs of booking accommodations and excludes other operational costs such as Customer Acquisition Costs (CAC).

Key Points to Understand Cost of Goods Sold (COGS) in the Travel Industry

Direct Costs: These are expenses directly related to providing the booked accommodation services. For example, if a travel agency books a hotel room for a customer, the amount paid to the hotel is considered part of the COGS.

Exclusion of CAC: Customer Acquisition Costs, which include marketing and sales expenses to attract new customers, are not part of COGS. This distinction is important for accurately calculating the gross profit margin.

Impact on Pricing: Understanding COGS helps travel agencies and booking platforms set competitive prices while ensuring profitability. By keeping COGS under control, businesses can improve their profit margins.

Gross Profit Calculation: Gross profit is calculated by subtracting COGS from total sales revenue. This figure provides insight into the financial health and efficiency of the business in converting sales into profits.

Conclusion

By maintaining a clear understanding of COGS, travel agencies can better manage their finances, optimize their pricing strategies, and ensure sustainable growth in a competitive market.